Thinking about what you should do with your “investments?” The only reason you bought them was in the hope that you could sell sometime later to someone else at a higher price. As soon as the likelihood for that to occur is diminished it is always better to sell. How can the decision be so easy? In a non-taxable account, why not sell and preserve your capital, especially when there are no tax considerations?

Holding on to equities won’t make you rich, while declining prices will jeopardize your portfolio health.

For taxable accounts, you can always hedge with options or short the same stock that you are holding long. If you don’t have some form of protection plan in place you’re just gambling unnecessarily… and you don’t belong in the game.

I want you to think about something: it is nearly impossible for anyone to make enough money to support themselves as an “investor” – the professionals survive by selling services and advice, not from investing. All that matters is when you sell… so, come to your own conclusions about protecting yourself.

The reason I can be so casual is because I’m not in a position to lose anything.

Use those upticks, while you have them to go short… For investors in other countries that was partially taken away yesterday evening. Officials in France, Italy, Belgium, and Spain, all announced short selling in specific financial stocks would be banned starting today (August 12).

After efforts by the European Securities and Market Authority (ESMA) to put together a coordinated short-sale ban across the European Union fell through, the four countries each rolled out their own individual restrictions on the short selling of most major financial institutions.

On September 19, 2008, a short selling ban was instituted on financial stocks in the United States and remained in place until October 8, 2008. You may recall the great interview with Ken Griffin of Citadel in the December 22, 2008 issue of Fortune Magazine. It substantially negatively impacted their portfolio health.

Here’s news from today: Aug. 12 (Bloomberg) — Citadel LLC, the $11 billion hedge fund run by Ken Griffin, raised its stake in Evercore Partners Inc. to 5.2 percent as it ends a three-year effort to build its own investment bank. http://www.sfgate.com/cgi-bin/article.cgi?f=/g/a/2011/08/11/bloomberg1376-LPTK1I0YHQ0X01-4PL3PU21Q9L1O4AM0R0AA0HG12.DTL#ixzz1UqG1RUMi

In the December 22, 2008 Fortune article Citadel is cited as a $15 billion firm after the September/October financial market decline.

But let’s get back on track about short-sale bans…

France, Italy, Belgium, and Spain, also instituted short-sale bans in 2008, roughly around the same time as the U.S. However, these countries kept their bans in place far longer than the U.S. Regardless, it did not stop the decline in bank stocks and simply limits your avenues to hedge, which is useful for retail investors who cannot get approval to trade options.

When looking at the countries that did not ban short selling, such as, Singapore, Hong Kong, Israel and Sweden for example, declines in the share prices of bank stocks took place as well.

Bank stocks weren’t fundamentally attractive at the time so there was no reason to buy them, and with a ban on short selling of financial stocks, it makes it seem a stronger argument that there aren’t any reasons to buy.

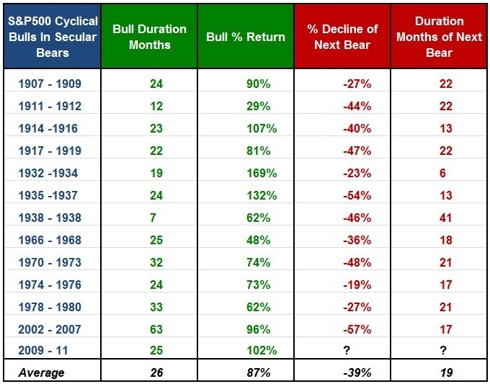

As for bear market expectations, here’s a very limited example:

On April 29, 2011, the S&P500 (SPY) reached a closing high of 1363.61. At the end of January 1998, the S&P 500 was at 1050.5, and during August 1998 was the surprise S&P 500 decline triggered from the financial woes in the Russian market.

I don’t see how the market environment today is any better than August 1998 – and even during the mid to end of the 90s analysts were very concerned that the U.S. stock market was inflated. Remember the “irrational exuberance” comment toward the end of 1996 – yet we’re in much worse global markets and no one thinks irrational exuberance about the U.S. stock market today?

Market snapshot:

The Dow Jones Industrial Average (DJIA) increased 3.9% to close yesterday at 11,143.31. The Standard & Poor 500 (S&P 500) jncreased 4.6% to close at 1,172.64 and the Nasdaq Composite Index increased 4.7% to finish the day at 2,492.68. The CBOE Volatility Index decreased 9.3%. It was another busy day on the New York Stock Exchange, NYSE Amex and Nasdaq, with consolidated volumes totaling 12.99 billion shares, compared with the year’s estimated daily average of 7.8 billion. On the NYSE, for every 12 stocks that jumped up, only one stock was on the losing side.

The DJIA has never ever exhibited this amount of one-day percentage moves within a week (in the last four trading days). This was the indexs fourth straight day of over 400-points of movement, including the 423 points movement yesterday.The DJIA gained 3.9% yesterday, declined 4.6% on Wednesday, climbed 4% on Tuesday, and decresed 5.6% on Monday. Over the same period, the S&P 500 moved up 4.6%, down 4.4%, rose 4.7% and declined 6.7% a day before that. The Nasdaq gained 4.7% yesterday, declined 4.1% on Wednesday, rose 5.3% on Tuesday and declined 6.9% on Monday.

And you want to hang on because you’re too scared to sell? We’re searching for equilibrium here… frankly, domestic and global economic conditions don’t change in twenty-four periods, so there’s nothing of merit in any subsequent increase after a decline. We’re simply refusing to see domestic and global economic conditions clearly… and to let the truth set us free from all these false assumptions about growth. Even in the boom times of the dot com era actual economic conditions were not good, how people are able to wish the market up from here is beyond me.